Our RISA tool is being updated for a better mobile experience. For the best experience, please use a tablet or computer to use our tool

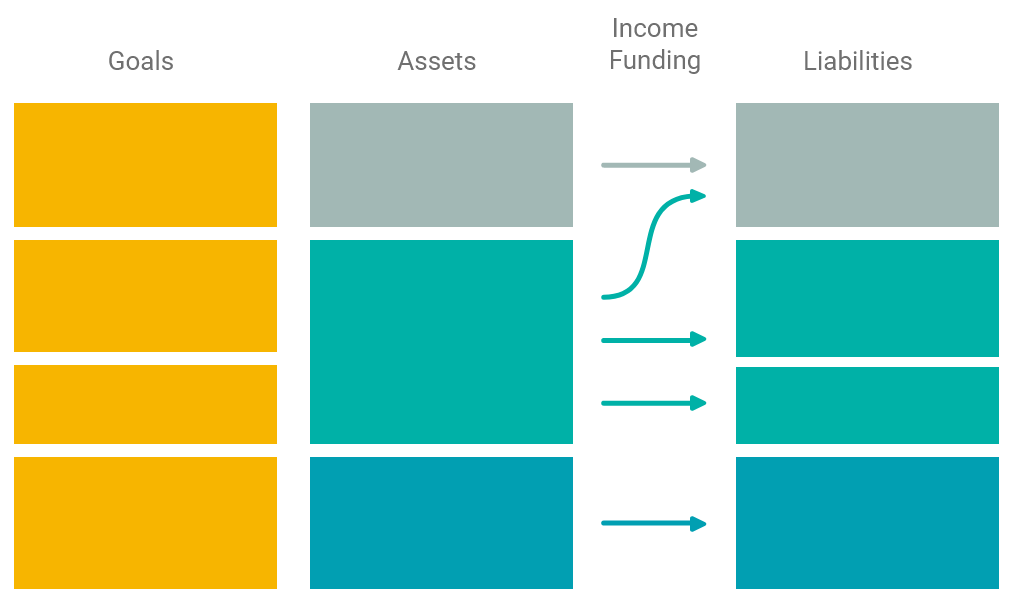

RIO™ Map Framework

Your Goals

This is about being purposeful with your retirement, so we start with where you want to go and how your retirement income concerns affect them.

Your Assets

Your assets break down into three categories: Reliable Income Sources, Diversified Portfolio, and Reserves. These are used to fund your future Liabilities.

Retirement Funding Plan

Your Retirement Funding Plan section explores how coordinated is your plan. How do you envision yourself on this retirement income journey.

Liabilities

The Liabilities section of the RIO™ Map are the funds needed for your goals. Each goal type relates to a liability: Longevity Goals, Lifestyle Goals, Legacy Goals, and Liquidity Goals.

The first step in understanding your RISA™ Profile is to understand its framework. Our RIO™ Map provides this framework. It is based on our research in the field of retirement income.

The RIO™ Map is comprised on the following factors:

- Your Goals

- Assets

- Retirement Funding Plan

- Liabilities

Your Goals

Let’s start with your goals. This is about being purposeful with your retirement, so we start with where you want to go and how your retirement income concerns affect them. We have narrowed goals down to four primary categories, which we call “The 4 L’s of Retirement.”

Longevity

These goals relate to ensuring you do not outlive your assets.

Lifestyle

These goals include to how you want to live your life and focus on maintaining your desired standard of living.

Legacy

These goals relate to leaving assets for subsequent generations or to charities. They also detail how impactful you want to be while alive.

Liquidity

These goals involve maintaining enough reserves for unexpected contingencies. The proverbial need for the "rainy day" account.

Within your RISA™ Profile, we frame these as Your Retirement Concerns.

Your Assets

Reliable Income

These sources are an essential part of drawing consistent income.

Diversified Portfolio

This section covers your investment approach.

Reserves

This part outlines how you want to handle contingency planning.

Reliable Income

Reliable Income sources are an essential part of drawing consistent income.

This section helps answer an essential retirement income planning question: “How can you create a reliable income floor that is safeguarded from market volatility?” These variables are used to offset essential expenses and longevity goals. They determine what kind of income floor you can count on.

Diversified Portfolio

Your Diversified Portfolio reviews your investments. It identifies how well you are positioned to effectively capture market rates of return, and how to practically manage your portfolio.

This section further helps you identify strengths and weaknesses in your own investment knowledge and application that could lead to good or poor outcomes. This portion significantly impacts your Lifestyle and Legacy goals.

Reserves

The Reserves section pertains to how well-positioned you can absorb any potential external shocks to your retirement income streams, such as job loss, unexpected death, chronic illness diagnosis, and much more.

We want to assess how you want to position yourself for contingencies such as these that can disrupt your retirement plans.

Retirement Funding Plan

Your Retirement Funding Plan section explores how coordinated is your plan. How do you envision yourself on this retirement income journey with regards to your retirement income distribution plan across your reliable income sources, investment portfolio, and reserve assets?

Liabilities

The Liabilities section of the RIO™ Map are the funds needed for your goals. Each goal type relates to a liability: Longevity Goals are related to essential expenses, Lifestyle goals are related to discretionary expenses, Legacy goals are related to legacy expenses, and Liquidity goals are related to contingencies.

This part of the RIO™ Map functions dynamically to ensure the Goals, Assets, and Income Funding strategies are continually aligned.

Your RISA™ profile is set against this framework in order to provide a clear understanding of how you can best proceed on your retirement income journey.

In the next section, we will review your RISA™ Profile with the first section of the RIO™ Map; your goals and retirement risks.