Our RISA tool is being updated for a better mobile experience. For the best experience, please use a tablet or computer to use our tool

Your Retirement Concerns

RIO™ Framework- The 4 Ls

Your RISA™ Profile reflects how you want to account for your goals and concerns when reviewing your retirement income plan. While there are many retirement goals, our RIO™ Map™ narrows them down to four primary categories, “The 4 L’s of Retirement.”

These not only represent your goals, but each come with their own set of retirement risks that can cause you great concern.

Longevity

Longevity goals and concerns are centered around addressing the main risk of retirement: outliving your money.

Most examples center on financial independence and knowing that you can pay your basic expenses and not be a burden to others. These include but are not limited to:

- Daily living expense

- Housing – Choosing your own living situation, such as staying in your home, downsizing, or moving somewhere new

- Healthcare – Being able to pay for your medical expenses throughout retirement

Lifestyle

Lifestyle goals and concerns focus on maintaining your desired standard of living and enjoying your retirement with more discretionary spending. These goals require you to maximize your spending power.

In other words, this aspect of retirement planning is about maintaining your current or better lifestyle, rather than living too conservatively for your liking throughout retirement. This also includes being able to spend on others without impeding your retirement success.

Typical Lifestyle goals for you and your partner include:

- Travel & Leisure – taking trips, and doing fun activities

- Self-Improvement – Investing in your personal growth, such as taking classes and learning new skills

- Social Engagement – Enjoying the company of friends and family

- Vicarious Enjoyments – These can include assisting with tuition for the benefit of a family member or other

Liquidity

Liquidity goals and concerns involve maintaining enough reserves for unexpected contingencies. This is the proverbial need for a rainy-day account.

Maintaining enough liquidity is especially important when it comes to:

- Supporting the family during emergencies

- Accounting for any repairs or home improvement necessities

- Accounting for an unexpected death (e.g., you or your partner)

- Accounting for an unexpected health event or illness

What if you were suddenly diagnosed with a chronic illness? It would most likely require a change in perspective and costs in retirement. Are you prepared?

Legacy

Legacy goals and concerns are about leaving assets for subsequent generations or to charities, as well as contributing to impactful activities with your time and talent. The thought of leaving behind a legacy is a consistent theme here. While many people think of leaving a legacy as something that happens after you have passed, legacy goals can certainly occur while you are alive.

Typical goals include:

- Family Bequests – Leaving money to your family and doing so with minimal taxes and hassles

- Giving Back – Contributing to causes important to you with your time and financial assets

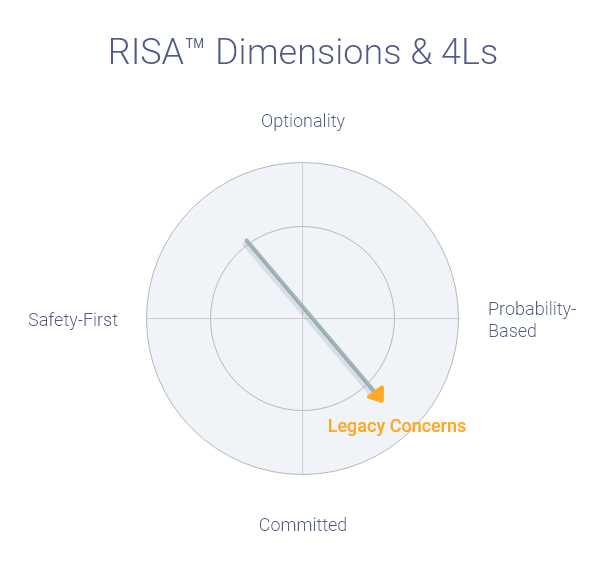

Your RISA™ Profile is significantly related to your Retirement Income Concerns.

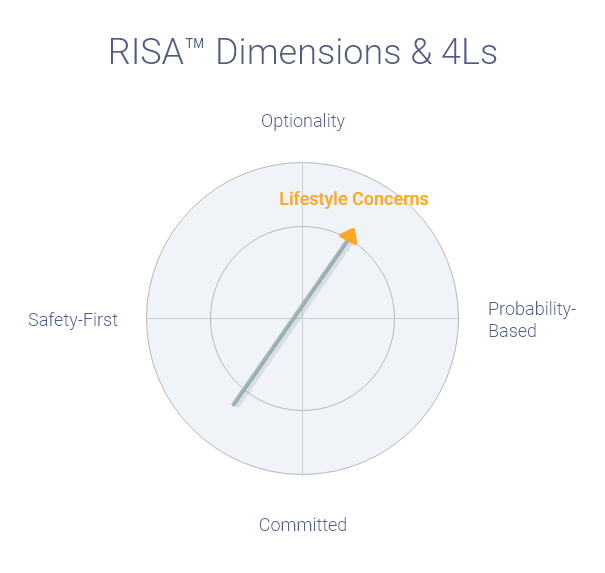

Individuals more concerned with Lifestyle goals tend to identify with more Probability and Optionality based solutions. These solutions move toward the upper right RISA™ Quadrant because to address those concerns you need to take on more market risk and be more flexible with your income strategies.

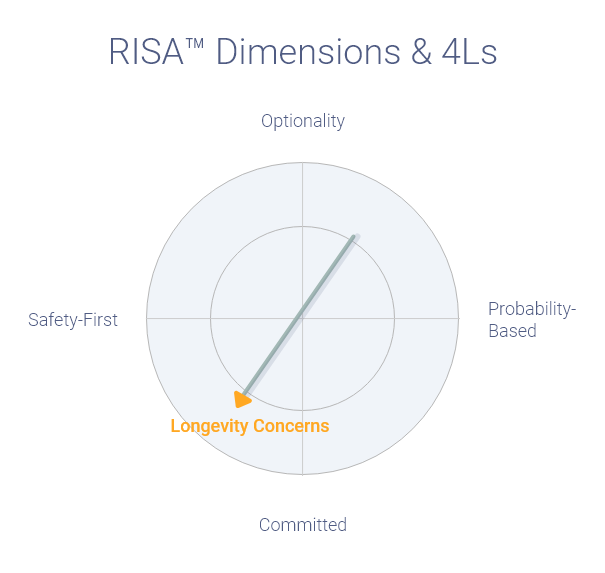

Individuals more concerned with Longevity goals tend to identify with more Commitment oriented solutions. These solutions move toward the lower end of the RISA™ Quadrants because contractual income sources, like an annuity, may require a significant level of commitment to purchase.

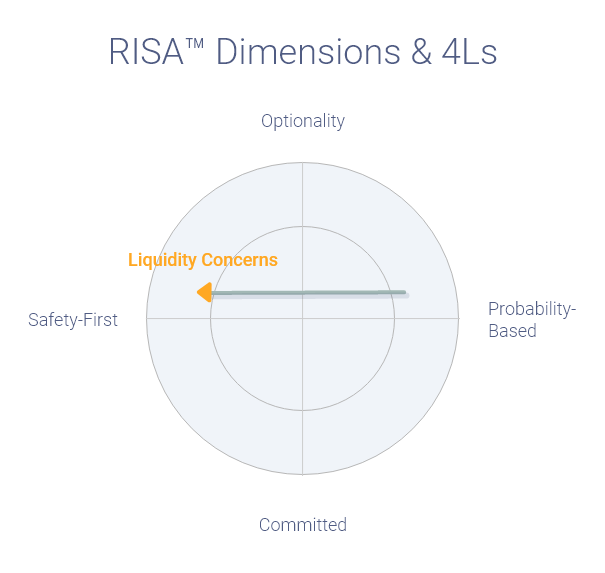

While a general concern for all, individuals most concerned with Liquidity goals tend to identify with more Safety-First solutions. These solutions move toward the left side of the RISA™ Quadrants because safety-first income sources can readily provide the needed liquidity during the moments that require them. These solutions include but are not limited to cash options and insurance.

While there is generally a low level of concern regarding legacy risks, individuals more concerned with Legacy goals tend to move toward more Commitment-oriented and Probability-based solutions. It seems that while individuals may commit to bequests by specifically earmarking assets, they do so with volatile investable assets. As an example, a parent may wish to make sure at all times that they can bequest a specific amount from their investment portfolio to their heirs.

In the next section, we will continue our progression through the RIO™ Map and how your RISA™ Profile corresponds to your Reliable Income strategy.