Our RISA tool is being updated for a better mobile experience. For the best experience, please use a tablet or computer to use our tool

Your RISA™ Profile

Your RISA™ Profile is based on the following dimensions:

Your Probability versus Safety-First Dimensions

These dimensions detail how you prefer to source retirement income from your assets.

Probability-based income sources are dependent on the potential for market growth to continually provide you with a sustainable retirement income stream throughout your life. This includes a traditional investment portfolio or other assets that have the expectation of growth in order to subsidize your retirement income.

Safety-First income sources are dependent on contractual obligations for income. These sources of income are more immune from market swings. A safety-first approach may include protected sources of income common in pensions, most annuities, and individual bonds. This approach is not dependent on the expectation on probable market growth since the income is contractually driven.

Your Optionality versus Commitment Dimension

These dimensions detail how flexible you prefer to be regarding your reliable income solutions.

Your Optionality dimension reflects a preference to keep your retirement income options open in case something more favorable develops in the future or your personal situation merits a change in your current plan. These include investment solutions that do not have pre-determined holding periods, can be sold expediently, and do not incur a meaningful loss of value resulting from the sale of the holding.

Your Commitment dimension reflects a preference to commit to retirement income solutions that resolve a retirement income need throughout your life regardless of your changing personal or economic developments. Your concern about avoiding potential negative developments, both personally and economically, as it relates to your ability to draw retirement income outweighs the potential benefits of more positive developments.

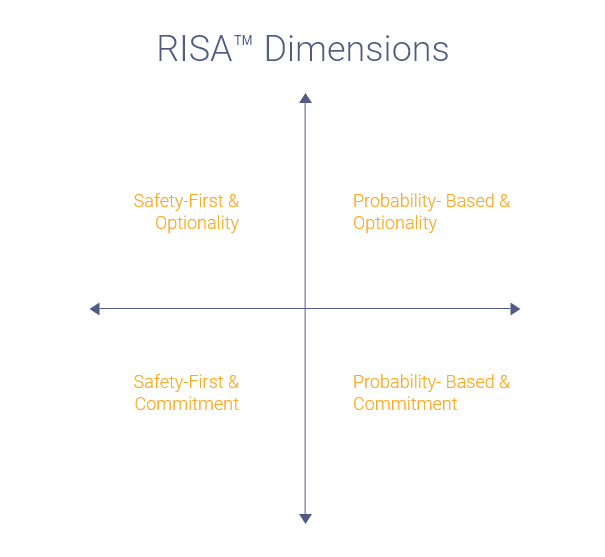

These dimensions combine to identify your RISA™ Profile.

They have reliably been shown to be significantly related to your retirement income concerns, strategy, tactics, income plan preference, and personal outcomes.

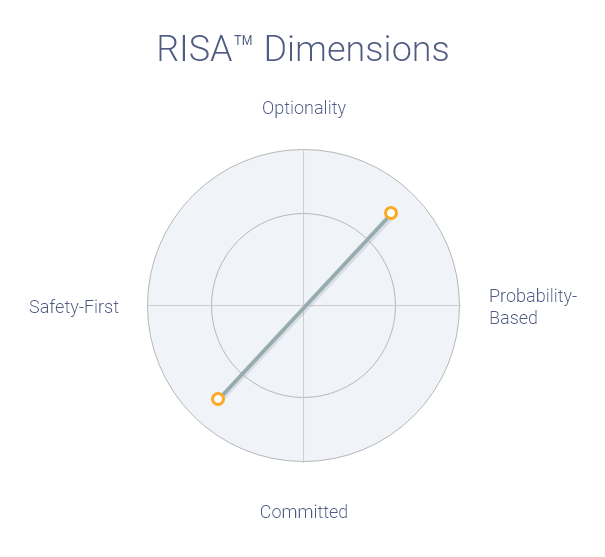

In the multidimensional view below, you can see how these factors complement each other very well.

You have a stronger preference for Probability-Based and Optionality solutions.

You have a stronger preference for Probability-Based and Commitment-oriented solutions.

You have a stronger preference for Safety-First and Commitment-oriented solutions.

You have a stronger preference for Safety-First and Optionality-oriented solutions.

We find that most RISA™ Profiles tend to be between the top right and bottom left quadrant. This is because our research shows that there is a significantly strong positive relationship between a Safety-First and Commitment oriented preference and significantly strong positive relationship between Probability-Based and Optionality oriented preferences.

In the next section, we will discuss a framework for better understanding your RISA™ Profile within the context of a retirement income plan.