Our RISA tool is being updated for a better mobile experience. For the best experience, please use a tablet or computer to use our tool

Your RISA™ Reliable Income Strategy

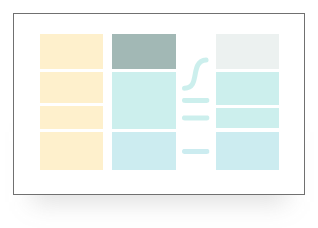

As we move across the RIO™ Map, we can begin to identify your assets and how you utilize them in your retirement income plan. The RIO™ Map breaks your assets down into three categories: Reliable Income, Diversified Portfolio, and Reserves.

A nice way to think of the assets section of the RIO™ Map is:

Let’s start with the Reliable Income Section and your RISA™ Profile.

RIO™ Framework - Reliable Income

Reliable income sources are an essential part of drawing consistent income.

This section helps answer an essential question of retirement income planning: How can you create a reliable income floor that is safeguarded from market volatility?

Reliable income streams are used to offset essential expenses and fund longevity goals. They determine what kind of income floor in retirement you can count on regardless of any negative personal or economic developments.

This type of funding strategy applied to reliable income sources is broken down into two types. Funding an income floor for perpetuity or funding a floor for specific periods of time, time-based funding. Time-based funding strategies are frequently referred to as “bucketing strategies” in the popular press.

Your RISA™ Profile is significantly related to your Reliable Income strategy and tactics.

Our research shows that as your profile moves from the lower left to the upper right of the RISA™ Matrix your strategy preference will shift from more perpetuity-based solutions, like lifetime protected income from income annuities, to more time-based solutions.

These strategy preferences indicate how your tactics may be best used within your retirement income plan. Aligning your RISA™ profile and reliable income tactics help ensure that you can identify solutions according to your personal preferences.

The tactics used to implement your Reliable Income strategy are:

- Social Security

- Income Annuities

- Pensions

- Bond Ladders*

- Continued Employment

- Reverse Mortgage

We will detail these for you in your Retirement Funding Plan section.

In the next section, we will continue our progression through the RIO™ Map and how your RISA™ Profile corresponds to your Diversified Portfolio strategy.

*An important note regarding how we view bonds within a bond ladders.

The discussion of bond ladders in this report specifically refers to using individual bonds to meet budgeted retirement expenses. We consider holding individual government bonds to maturity to generate desired cash flows to fund ongoing expenses throughout retirement. This attempts to protect your spending plan from volatility. We refer to bond ladders as sources of reliable income when they are part of a time segmentation strategy because they are risk-free, and you can directly match their yields and maturities with your expenses.

The use of bond ladders is a time segmentation strategy- also referred to as a bucketing approach. With a bucketing approach you establish a bond ladder to fund windows of expenses in retirement. These windows are dependent on your preferences, but they range from 1 to 3 years, 4 to 7 years, and more.

The role of bonds within your investment portfolio is different. The purpose of this type of bond vehicle, via bond funds or ETFs, is to dampen your portfolio’s overall volatility and not to serve as a direct source of reliable income. This type of bond approach is part of your asset allocation strategy in which you distribute a certain percentage from your investment portfolio each year to fund your retirement expenses. This is a total-return withdrawal strategy. When we provide suggestions to your investment portfolio’s bond allocation, we are only referring to the allocation of bonds within an investment portfolio.